The tech hiring landscape in 2025 is defined by paradox. On one hand, official data has become unreliable due to the prolonged government shutdown. On the other, real hiring activity across the private sector signals cautious optimism. For IT leaders and hiring managers, this disconnect creates both risk and opportunity — and a need to rethink how workforce decisions are made.

At Donato Technologies, a Dallas-based MBE, SBE, and HUB-certified IT solutions and staffing firm, we’ve seen firsthand how volatile market data impacts hiring forecasts and workforce planning. Understanding what’s really happening beneath the noise is essential to staying ahead.

The Data Dilemma: Which Numbers Can We Trust?

The ongoing federal government shutdown has created an unprecedented information gap. Traditional labor market measurements now conflict in ways we’ve never seen before.

According to ADP, the U.S. shed an average of 11,250 private-sector jobs per week through late October 2025 — a sharp reversal from earlier reports suggesting growth. Goldman Sachs estimated monthly losses of around 50,000 jobs, though this included roughly 100,000 government workers with deferred resignations. White House economic advisor Kevin Hassett went further, stating that some October data may never be collected at all.

The result? Private reports from organizations like ADP now carry more influence — but also more uncertainty.

For IT staffing leaders, this means relying solely on government data to predict hiring conditions is no longer a safe strategy. Instead, actionable insights must come from real hiring activity and direct employer behavior, not lagging indicators.

Dice Data: A Real-Time View of Tech Hiring Activity

The October 2025 Dice Tech Jobs Report analyzed more than 7 million postings, offering a rare, ground-level view of what’s happening inside tech hiring pipelines.

The findings are cautiously encouraging:

Tech job postings rose 12.9% month-over-month in September, one of the strongest upticks of the year. Yet the year-over-year figure remains down 2.5%, signaling that recovery continues but at a measured pace.

This type of insight underscores what we regularly observe through Donato’s staffing services — hiring hasn’t stopped; it has simply evolved.

Companies are still building teams, but they’re doing so more strategically, often prioritizing skills that directly enable operational resilience and scalability.

AI Skills: From Advantage to Requirement

AI has moved from buzzword to baseline.

According to Dice, 50% of U.S. tech job postings now require AI skills, up from 47% just a month earlier — a 98% increase compared to September 2024.

This confirms what our software development and IT consulting teams are already seeing in practice: companies now expect even non-AI roles to include some exposure to automation tools, data-driven decisioning, or machine learning frameworks.

For candidates, the takeaway is clear — AI fluency is no longer optional. For employers, this means re-evaluating your screening, upskilling, and long-term talent strategy to keep pace with the changing skill market.

Industry-Specific Hiring Trends: Uneven but Encouraging

The Dice report also shows sharp variations by industry:

High-growth sectors

-

Manufacturing → 108% month-over-month growth; 257% year-over-year, driven by automation and IoT initiatives

-

Insurance → 182% year-over-year growth

-

Telecommunications → 149% year-over-year growth

-

Engineering, Retail, and Software → 31–60% growth

These data points align with Donato’s active industry portfolio across manufacturing, insurance, utilities, and telecom — sectors where demand for system integration, IoT, and secure infrastructure remains strong.

(See our experience in Utilities & Energy and Telecom & Technology for more insights.)

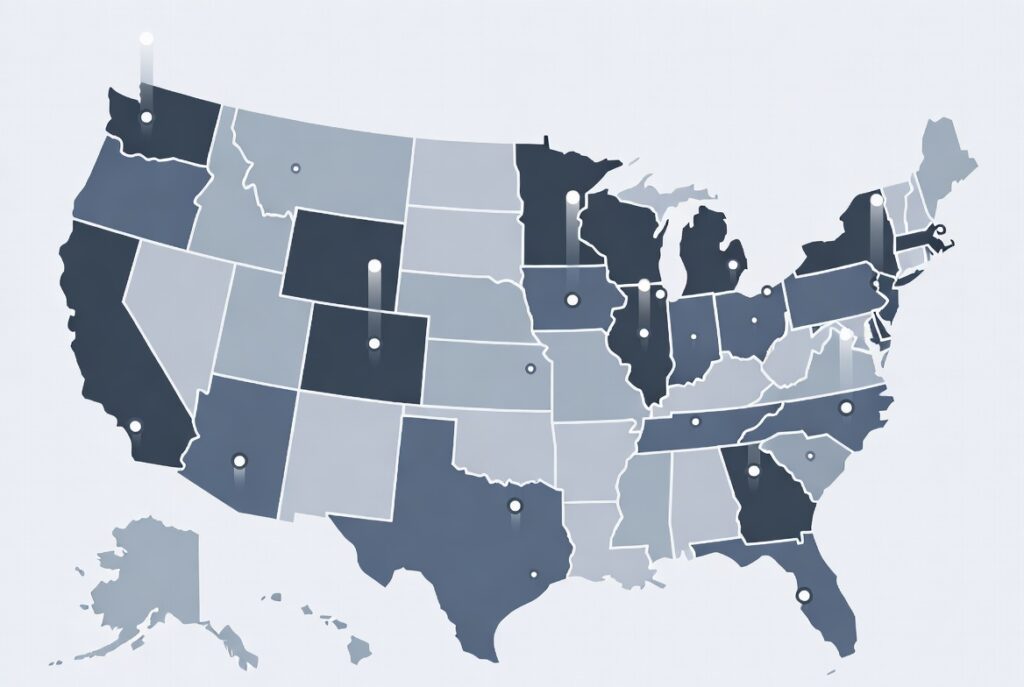

Geographic Realignment: The Rise of Secondary Markets

The U.S. tech labor map is shifting fast.

The U.S. tech labor map is shifting fast.

Traditional hubs like New York, Los Angeles, and Boston are cooling, while secondary markets are gaining ground:

Rising markets:

-

Illinois → +15% YoY

-

San Jose → +27% YoY

-

Austin → +21%

-

Chicago & Atlanta → +8% each

Declining markets:

-

Massachusetts, New Jersey, Washington DC → -10% to -11%

-

New York City → -8%

-

Texas overall → -4%

For employers, this means your talent sourcing strategy should now include both established and emerging tech centers. At Donato, our data analytics & business intelligence services help organizations make informed workforce decisions based on regional hiring trends, compensation shifts, and role saturation.

High-Demand Roles: The Backbone of Scalable Tech

Demand is surging for infrastructure and cybersecurity expertise:

-

Mainframe Systems Programmers, Application Security Engineers, and Cybersecurity Specialists → 200%+ MoM growth

-

UX Engineers & Application Support Analysts → ~175% MoM growth

-

Data Reporting & System Monitoring skills → 250–285% MoM growth

The pattern is clear: employers are prioritizing stability, compliance, and scalability over hyper-growth. As companies refocus on secure architecture and sustainable operations, specialized IT staffing becomes mission-critical.

(Explore our cybersecurity solutions for how Donato supports this evolution.)

Small Business Confidence: A Telling Wildcard

While tech hiring momentum is real, small business confidence remains at its lowest in six months, according to the NFIB Optimism Index. Since small and mid-market organizations represent a major share of the tech hiring base, this indicates a mixed recovery: larger enterprises are hiring, but smaller firms remain cautious.

What This Means for IT Leaders in 2025

-

Diversify your data sources. Don’t rely on federal job numbers — prioritize private hiring analytics, platform data, and your own recruiting insights.

-

Invest in AI skills development. Ensure both new hires and existing teams build fluency in AI-driven tools.

-

Explore secondary markets. Emerging tech cities like Austin, Chicago, and San Jose are now top talent sources.

-

Double down on high-demand niches. Cybersecurity, infrastructure, and system reliability skills are the new differentiators.

-

Plan for volatility. Even with positive hiring momentum, macroeconomic uncertainty calls for flexible workforce planning.

Closing Thoughts

The 2025 tech hiring environment is not defined by decline — it’s defined by redistribution.

Opportunities haven’t disappeared; they’ve shifted to new regions, new roles, and new skill sets.

At Donato Technologies, we help organizations navigate these shifts by connecting them with pre-vetted, high-performing IT professionals and by designing strategies that align talent acquisition with long-term business goals.

Learn more about how our IT staffing solutions and consulting services can help you adapt to the evolving tech market.